The First Half Of 2022 Finishing Package: Top 10 Brands Took 49.2%. KOHLER’s Share Of The Four Categories Took The First

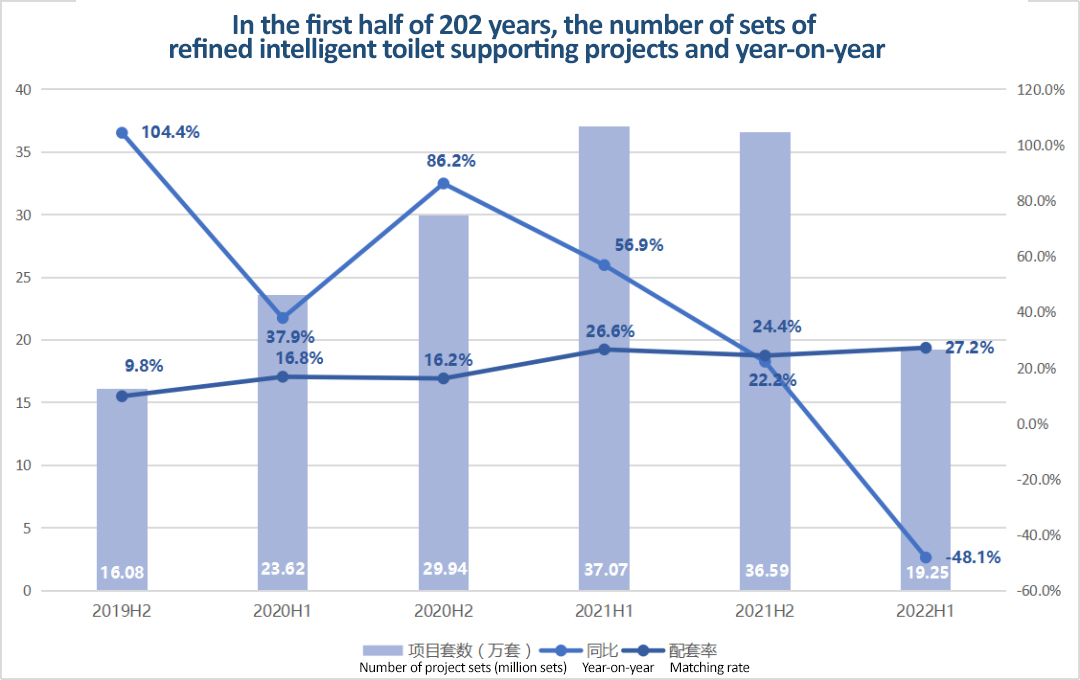

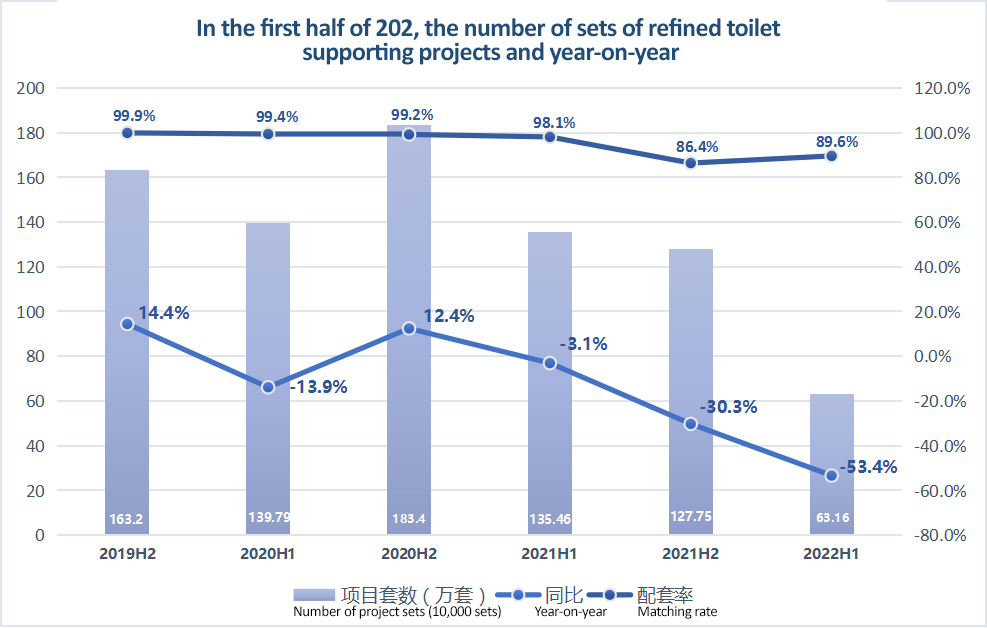

Recently, AVC (AVC) released the real estate big data show that: in 2022 January-June, 943 commercial residential fine-fitting opening projects, down 42.1% year-on-year. Its market size was 705,200 sets, down 48.9% year-on-year. As a standard component, toilet, shower, washbasin, bathroom cabinets are maintained at about 65-70 million sets, down year-on-year with the refined large plate. However, the comfort class bathroom products configuration rate has grown against the trend. The size of the smart toilet is 193,000 sets, an increase of 0.6% year-on-year. It has a configuration rate of 27.2%, of which the integrated machine accounted for up to 50%.

KOHLER occupies the first place in four categories

Foreign brands occupy 66.65% of the market share

According to Aowei Cloud data, in the first half of 2022, the brand concentration in the finishing sanitary ware market is high. top 10 brand share reached 49.2%. Among them, KOHLER‘s dominant position in the finishing sanitary ware market remains steady. It occupies 22% of the market share, an increase of 0.6% year-on-year. Its toilet, intelligent toilet, shower and washbasin products all occupy the first market share. Secondly, TOTO, Duravit, Moen and other brands in the bathroom head position also tends to stabilize.

In the TOP 10 brands, foreign brands still occupy a larger place, reaching 66.65%, and a relatively small year-on-year growth. The TOP3 brands are Jomoo, Arrow, Oppein, of which Jomoo’s market share increased significantly.

Data source: Aowei cloud network

Intelligent toilet supporting the scale of the year-on-year decline

Poly Group developed into a TOP1 developer

From the analysis of individual parts, in the first half of 2022, although the allocation rate of smart toilets has increased, the number of project sets year-on-year has been declining precipitously since the second half of 2020. Especially compared to the first half of 2021, the scale of smart toilets supporting refined decoration decreased by 178,200 sets.

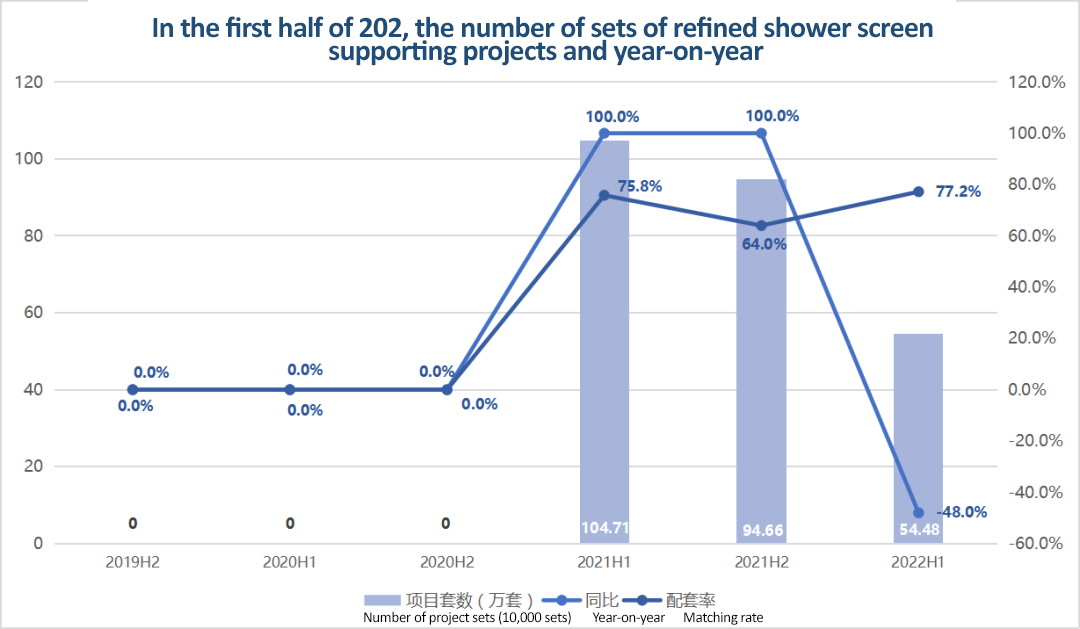

Shower room and bath, in the first half of this year, the finishing shower screen supporting scale reached 545,000 sets, down 48% year-on-year. However, the configuration rate was 77.2%, an increase of 1.4% year-on-year. Shower screen is mainly customized, with a market share of more than 40%. The scale of the shower bar supporting 512,700 sets, down 50.1% year-on-year. The configuration rate was 72.7%, a year-on-year decline of 1.6%. top1 brand is Opple, with a market share of 21.7%.

Data source: Aowei cloud network

In addition, in the first half of 2022, for example, the Chinese real estate finishing market. the TOP10 developers occupied a market share of 33.3%. Among them, the TOP1 developer is Poly Group Development, and it has a matching volume of 42,000 sets. The second place was taken by Vanke, with a matching volume of 39,000 units. China Overseas Property was in the third place with 31,000 units.

Poly Group Development and China Shipping Real Estate preferred toilet brand is KOHLER, occupying 47.8% and 34.1% of its supporting volume respectively. Vanke’s preferred brand is Jomoo, occupying 34.1% of its supporting volume.

The top 10 developers in the refined scale of year-on-year growth is China Resources Land, China Railway Construction, of which China Resources Land preferred brand TOTO. China Railway Construction preferred brand KOHLER.

Data source: Aowei Cloud Network

However, there is a significant decline in the volume of toilet fixtures in the Top 10 finishing market, such as the Poly Group toilet fixtures in the first place fell 20% year-on-year. As a standard component, the scale of the toilet supporting volume reflects to a certain extent the opening of the developer in the first half of this year.

Poly Group Development released its 2022 half-year results flash report, showing that from January to June 2022, the company achieved a contracted area of 1,373,100 square meters, down 21.78% year-on-year. The contracted amount was 210.221 billion yuan, a decrease of 26.29% year-on-year.

Difficulties will be normalized

Companies should control risks and enhance competitiveness

Aowei Cloud’s big real estate data shows that in June 2022, the real estate market showed signs of rebound. The size of China’s commercial residential refined property openings exceeded 210,000 sets. It jumped over 60% YoY and narrowed to -35.9% YoY. The scale is expected to be between 2.2-2.5 million units in 2022.

In addition, AVC predicts that if the epidemic improves in the second half of the year, consumer confidence in real estate will increase. In 2022, the supporting scale of the refined toilet is expected to reach 2.115 million sets. The size of the shower is 2.339 million sets, the size of the washbasin is 2.346 million sets, the size of the bathroom cabinet is 2.298 million sets, and the size of the smart toilet is 705,000 sets.

However, while seeing the positive factors, it is also important to note that according to the public information of the People’s Court Announcement Network, more than 216 real estate companies have issued bankruptcy announcements from January to July 2022. The head of the real estate companies thunder and the real estate market downward. This not only makes real estate companies suffer from huge pressure on their funds, but also puts the development of downstream suppliers under severe risks and challenges.

| Foshan Intermediate People’s Court, Guangdong Province | Foshan Maoguo Real Estate Development Co. | Bankruptcy Instruments | 2022-07-28 |

| Nangang District People’s Court of Harbin | Harbin Huahong World Trade Real Estate Development Co. | Bankruptcy Instruments | 2022-07-27 |

| Harbin Nangang District People’s Court | Harbin Huahong Nongbo Real Estate Development Co. | Bankruptcy instruments | 2022-07-27 |

| Harbin Nangang District People’s Court | Harbin Huahong World Trade Real Estate Property Development Co. | Bankruptcy instruments | 2022-07-27 |

| Shenzhen Iris Intermediate People’s Court of Guangdong Province | Shenzhen Qilutong Electronics Company Limited, creditors, etc. | Bankruptcy instruments | 2022-07-27 |

| Wuhan Huangpi District People’s Court | Wuhan Zhifeng Real Estate Falcon Group Co. | Bankruptcy instruments | 2022-07-26 |

| Ningbo Fenghua District People’s Court | Ningbo Meixia Real Estate Co., Ltd. creditors | Bankruptcy instruments | 2022-07-26 |

| Hanshan County People’s Court | Xianshan Yuxin Real Estate Development Co. | Bankruptcy instruments | 2022-07-25 |

| People’s Court of Supervalu City | Supervalu Guangda Real Estate Co., all employees, all creditors | Bankruptcy instruments | 2022-07-25 |

| Non-court units | Shin Kong Holdings Group Co. | Bankruptcy instruments | 2022-07-25 |

| Ruili People’s Court | Creditors of Wrist Town Heng Sun Real Estate Development Co. | Bankruptcy instruments | 2022-07-22 |

| Guyuan County People’s Court | Creditors of Zhangjiakou Kexie Real Estate Development Co. | Bankruptcy instruments | 2022-07-21 |

| Non-court units | Zhanjiang Donghai Island Economic Development Pilot Zone Real Estate Development Corporation | Bankruptcy instruments | 2022-07-21 |

Some industry sources believe that in the second half of 2022, the competitive environment faced by companies will still not improve. Difficulties will be normalized. Since last year, there have been a number of ceramics, sanitary ware and home improvement listed companies. In the earnings report said: the company’s real estate engineering business to proactively control risks and prudent strategy. The revenue of the strategic engineering channel in the reporting period declined.

At the same time, some companies have begun to change their business strategies, control costs, enhance the ability of independent innovation and competitiveness, and further improve the gross margin of the product.

WOWOW Faucets

WOWOW Faucets

您好!Please sign in